AI Powered

Quant Trading

Enter the New World of Crypto

Accurate Strategy Backtesting

Accurate backtesting faithfully recreates historical market conditions. Transparent strategy performance with proven high annualized returns builds confidence in your trades.

Up to

120%

Annual Return

Validated by past market data Proven performance at a glance

Supports

Second-Level

Backtesting Speed

Instant results output Accelerate strategy development

Optimized for the Crypto Market

Build from scratch in no time and launch trading bots effortlessly. No complex deployment — start instantly with one click, saving valuable time.

Just

1 minute

to Deploy

Instant activation Lower the technical barrier

Supports

12+

Strategy Integrations

Mix and match multiple strategies Boost practical efficiency

Smart Risk Control for Secured Returns

Built-in risk control safeguards your funds in real time. Stop-loss and take-profit always on point, shielding you from sudden market shifts and keeping trades on track.

Built-in

3-Layer

Risk Protection

Automatic triggers Limit loss exposure

Supports

Customizable

Stop-Loss Range

Flexible strategy adaptation Balance risk and return

Machine Learning Proprietary Strategies

Quickly capture hidden opportunities and unlock deeper data value. Proprietary algorithms continually evolve, keeping you one step ahead.

Over

1 Million

Training Data

Continuous optimization Generate robust strategies

Supports

12+

Trading Models

Capture arbitrage opportunities Across different market cycles

Trading Terminal

Seamlessly connect multiple exchanges in one place and manage scattered accounts with ease. Cross-platform operations made more efficient.

Supports

5 Major

Crypto Exchanges

Access top market liquidity Max rebates with full security

Maintains

ms-Level

API Interaction

Real-time market sync Precise execution

24/7 Automated Trading

Non-stop execution around the clock — algorithms never tire. Capture every market swing without missing any potential opportunity.

Continuous

365 Days

Uninterrupted Operation

Always on guard Capture every market move

Supports

ms-Level

Order Execution

Place trades ahead of the market Boost win rates

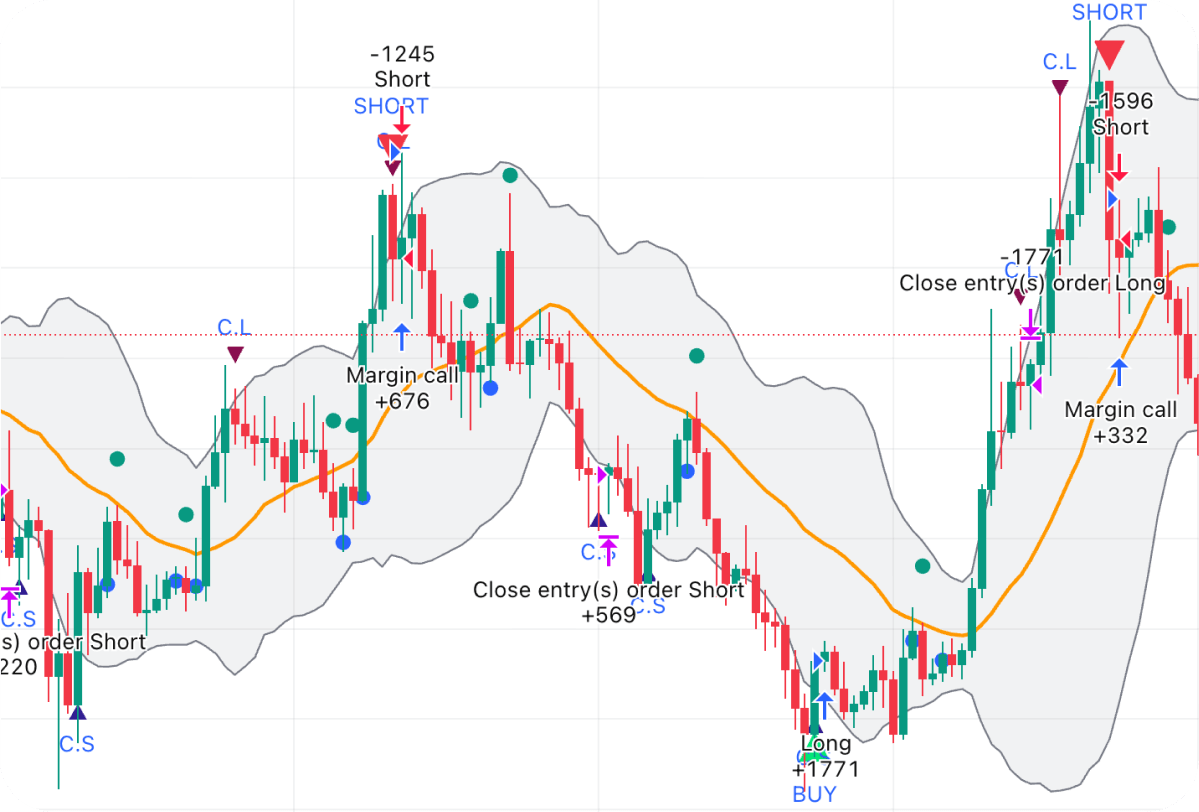

Dual-Side Hunter

Overbought/Oversold Detection + Dynamic Volatility Channel

Dual-Side Hunter combines momentum signals with volatility range filters. When the market swings excessively up or down, RSI identifies overbought or oversold conditions, while Bollinger Bands confirm whether price has reached an extreme zone. Together, they generate precise entry and exit signals. An intelligent drawdown filter further eliminates false signals, ensuring each trade is more efficient and valuable.

Dual-Side Profit

Automatically adjusts signal sensitivity to market volatility, avoiding frequent misjudgments in low-volatility conditions.

Smart Filtering

Built-in rise/fall thresholds reduce false signals and prevent excessive unproductive trades.

Reversal Capture

Detects reversal opportunities with precision when price touches Bollinger boundaries alongside extreme RSI values.

Volatility Adaptation

Automatically adjusts signal sensitivity to market volatility, avoiding frequent misjudgments in low-volatility conditions.

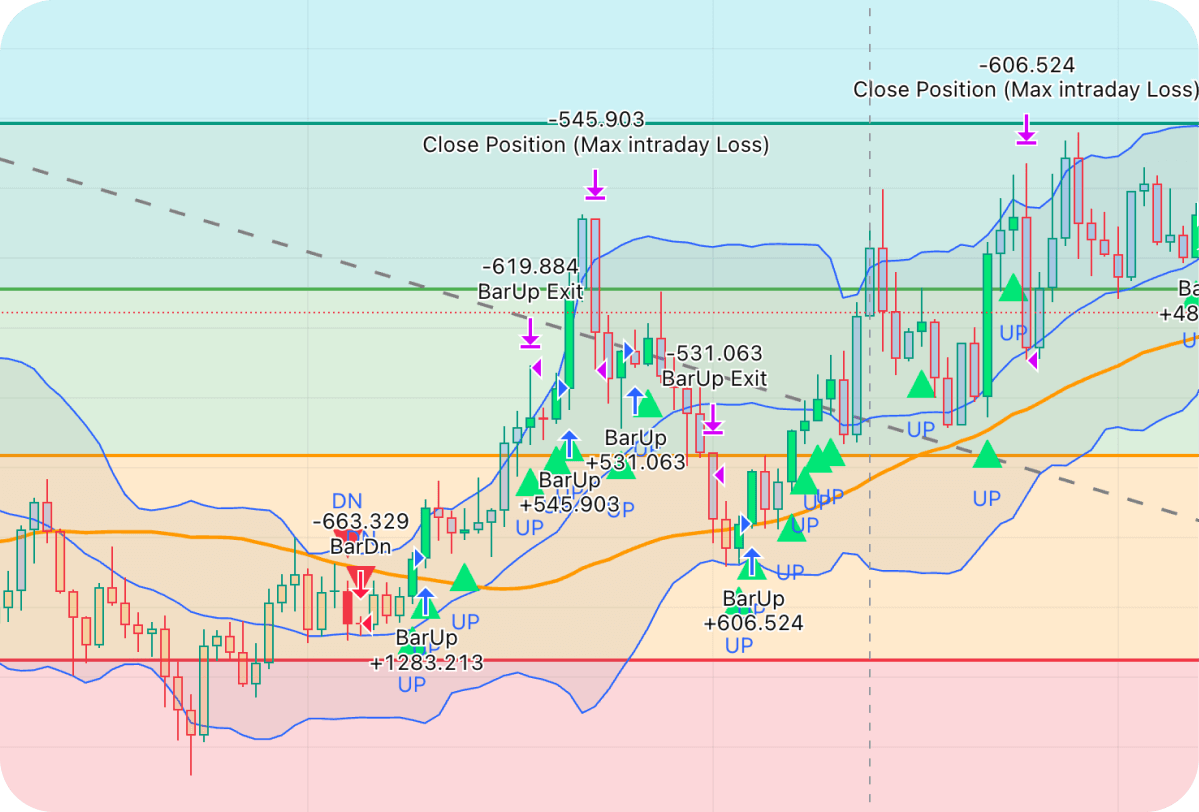

Momentum Catcher

Trend Filtering with Candlestick Breakout Detection

Momentum Catcher leverages trend moving averages and Bollinger Bands for dual confirmation, combined with unique BarUp/BarDn pattern recognition, to identify high-probability breakout opportunities in trending markets. When a strong candlestick forms during an uptrend and stabilizes above the Bollinger lower band, the strategy goes long. When a weak candlestick forms during a downtrend and touches the Bollinger upper band, it goes short.

Trend Confirmation

Filters market direction and trades only in genuine trending conditions.

Candlestick Breakout

Proprietary BarUp/BarDn recognition locks in precise buy and sell breakout points.

ATR Risk Control

Employs dynamic stop-loss and take-profit mechanisms, strictly managing risk while maximizing profit potential.

Offense and Defense

Strikes decisively in trending markets and protects automatically in ranging markets—balancing profit and stability.

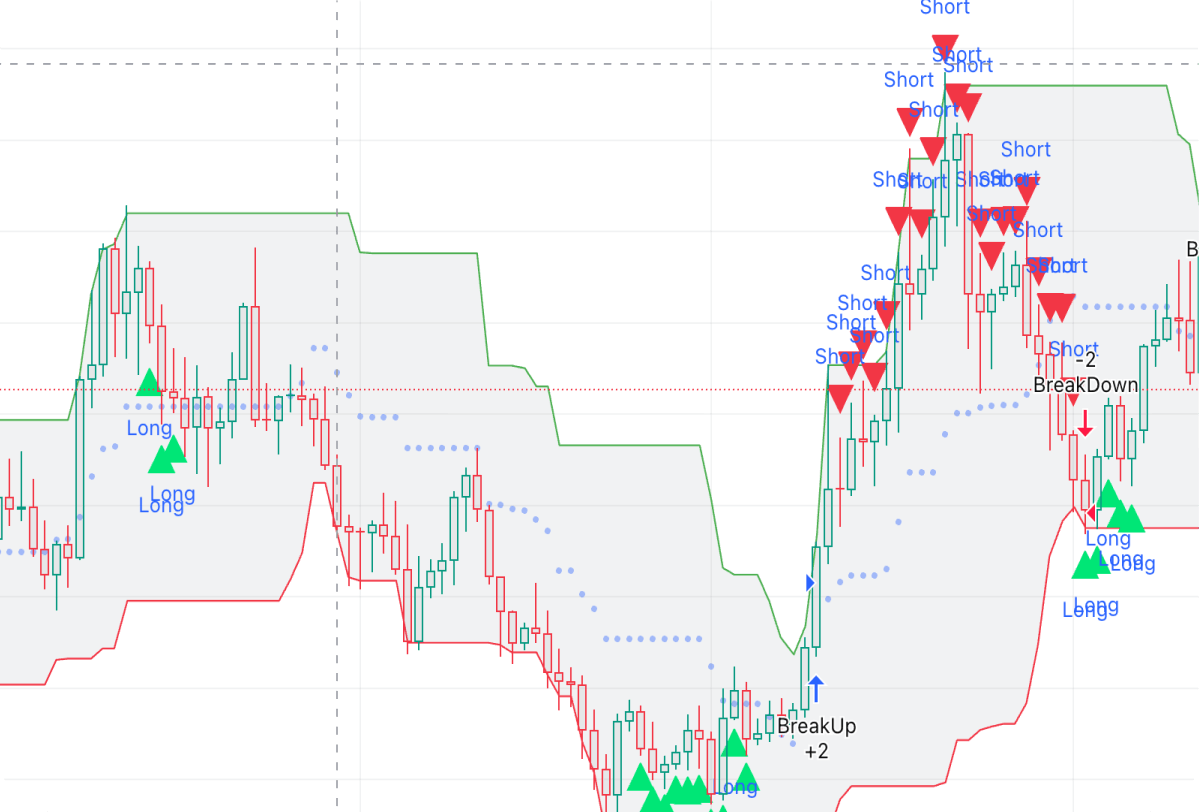

Trend Sniper

Channel Breakouts with ADX Trend Filtering

Trend Sniper is built on the 20-day price channel principle to capture key breakout points, filtered by ADX trend strength to eliminate false breakouts in choppy markets—achieving true trend-following. This dual confirmation mechanism allows the strategy to boldly go long in uptrends and decisively short in downtrends, significantly improving signal accuracy and win rate.

Trend Filtering

Ensures trades only trigger when trends are clear, avoiding false breakouts in ranging markets.

Noise Avoidance

Uses ADX thresholds to automatically filter out weak markets, reducing ineffective trades and improving efficiency.

Trend Alignment

Breakouts only trigger when trends persist, naturally aligning with the market's "strength begets strength, weakness begets weakness" principle.

Dual-Side Deployment

Offers both long and short breakout signals, flexibly adapting to uptrends and downtrends to capture opportunities across the market.

ZeroX Community

Community Showcases Never Stop

Join Early, Gain Early

Success Stories Keep Coming

小夏y

ZeroX delivers steady profits

”Using ZeroX for almost 3 months. Drawdown stays under 10% which is solid. Much better than when I was trading manually

MacroPulse

Strategy performance exceeds expectations

”Love how ZeroX's AI adjusts parameters automatically. My returns are up 30%+ from before, way better than I expected!

Alx

24/7 automated trading

”24/7 auto trading is a game changer. No more late nights watching charts. Returns are steady and risk is managed well

Partners

Backed by leading institutions in the crypto industry

OKX

A new era of blockchain, freer trading. Join OKX for a permanent 20% trading fee reduction

Binance

Join the world's leading crypto trading platform now! Get up to $450,000 in premium tokens!

Bybit

The most professional trading platform. Deposit and get up to $30,000 in experience funds. Make Easy Money!

Bitget

At Bitget, trading is life. Register now for $1,500 mystery box rewards and a 20% commission rebate

Gate.io

12-year veteran exchange. Trade crypto safely and get up to $10,000+ rewards! 20% fee rebate on registration

OKX

A new era of blockchain, freer trading. Join OKX for a permanent 20% trading fee reduction

Binance

Join the world's leading crypto trading platform now! Get up to $450,000 in premium tokens!

Bybit

The most professional trading platform. Deposit and get up to $30,000 in experience funds. Make Easy Money!

Bitget

At Bitget, trading is life. Register now for $1,500 mystery box rewards and a 20% commission rebate

Gate.io

12-year veteran exchange. Trade crypto safely and get up to $10,000+ rewards! 20% fee rebate on registration

OKX

A new era of blockchain, freer trading. Join OKX for a permanent 20% trading fee reduction

Binance

Join the world's leading crypto trading platform now! Get up to $450,000 in premium tokens!

Bybit

The most professional trading platform. Deposit and get up to $30,000 in experience funds. Make Easy Money!

Bitget

At Bitget, trading is life. Register now for $1,500 mystery box rewards and a 20% commission rebate

Gate.io

12-year veteran exchange. Trade crypto safely and get up to $10,000+ rewards! 20% fee rebate on registration

FAQ

How is quantitative trading superior to manual trading?

Most of the time, we cannot continuously monitor market trends and provide accurate analysis, especially when we're away (sleeping, working, etc.). Quantitative trading robots can accomplish this task through 24/7 market trend monitoring, analysis, and accurate insights to maximize user profits. This is where quantitative trading excels.

Is it safe to trade with ZeroX?

Yes. User funds are securely held in custody on our exclusive exchange partner platforms and protected by proof-of-reserves systems. Through API key integration and permission settings, once users complete API binding between our exclusive exchange partner platforms and ZeroX, ZeroX can be used safely. This allows users to generate consistent profits with peace of mind.

How do ZeroX's quantitative trading robots operate?

With our exclusive quantitative trading system and AI-driven quantitative strategies, our robots automatically complete all trading, conduct market analysis, and optimize your fund management after setup.

How can I get help if I have questions about my account or trading?

We have over 70,000 users globally. Users can join our community groups on Telegram. We welcome users to ask and view any matters related to ZeroX trading in the community groups. Our customer service will provide solutions to your inquiries, and even friendly community members from around the world will offer helpful feedback!

CONTACT US

Question? Simply just ask!

Real-Person Customer Support & Service

We process all strategy, subscription, technical support in our Telegram group

Contact Email

Please send your inquiries to our support email

Reply within 24 hours on weekdays